Schools across the valley are encouraging financial education through curriculums such as Banzai and Next Gen Personal Finance (NGPF), which are helping to expand financial literacy access into many more classrooms.

The educational resource Banzai follows Montana’s state curriculum requirements and offer an avenue for anybody in the community to increase their financial literacy, including kids. After completing a course, students will know how to track money, recognize financial trade-offs and plan for a financially sound future.

Since 2018, Park Side Credit Union has worked with Banzai to build financial literacy in the valley by investing time, money and industry experience to craft the virtual resource to better equip its surrounding community. Banzai’s online curriculum is made available to 23 schools in the valley in partnership with Park Side Credit Union.

The move to educate students on financial responsibility stems from parents and local financial institutions wanting younger generations to be better equipped with finance skills to prevent future money problems.

“We view it as our serious responsibility to provide education to our members and communities by offering financial literacy to people of all ages,” Josh Kroll of Park Side Credit Union said.

Kroll said too often people find out too late that they can’t receive more credit because of past mistakes. Park Side Credit Union saw the program as an opportunity to solve those problems before they happen.

Teaching financial literacy can prepare youths for lifelong financial success. According to NGPF, high school graduates with guaranteed financial education are 21% less likely to carry a balance on a credit card while in college, submit the Free Application for Federal Student Aid (FAFSA) 3.5% more often and use subsidized students loans 13% more often. Students who receive financial education are also less likely to fall prey to high-cost predatory loans than their peers who don’t have access to a personal finance curriculum.

Teachers who register with NGPF receive a free online toolkit alongside lesson plans and assessment for both the high school and middle school levels. Students learn about taxes, types of credit, investing and insurance through classroom activities and question sets. Online “arcade games” also provide students with decision-making responsibilities around paying for college and more.

Bigfork Middle School sixth-grade teacher Elizabeth Fetterhoff believes that personal finance education is an investment in a child’s future financial well being. She also hopes that developing finance skills will reduce mental health problems brought on by money worries.

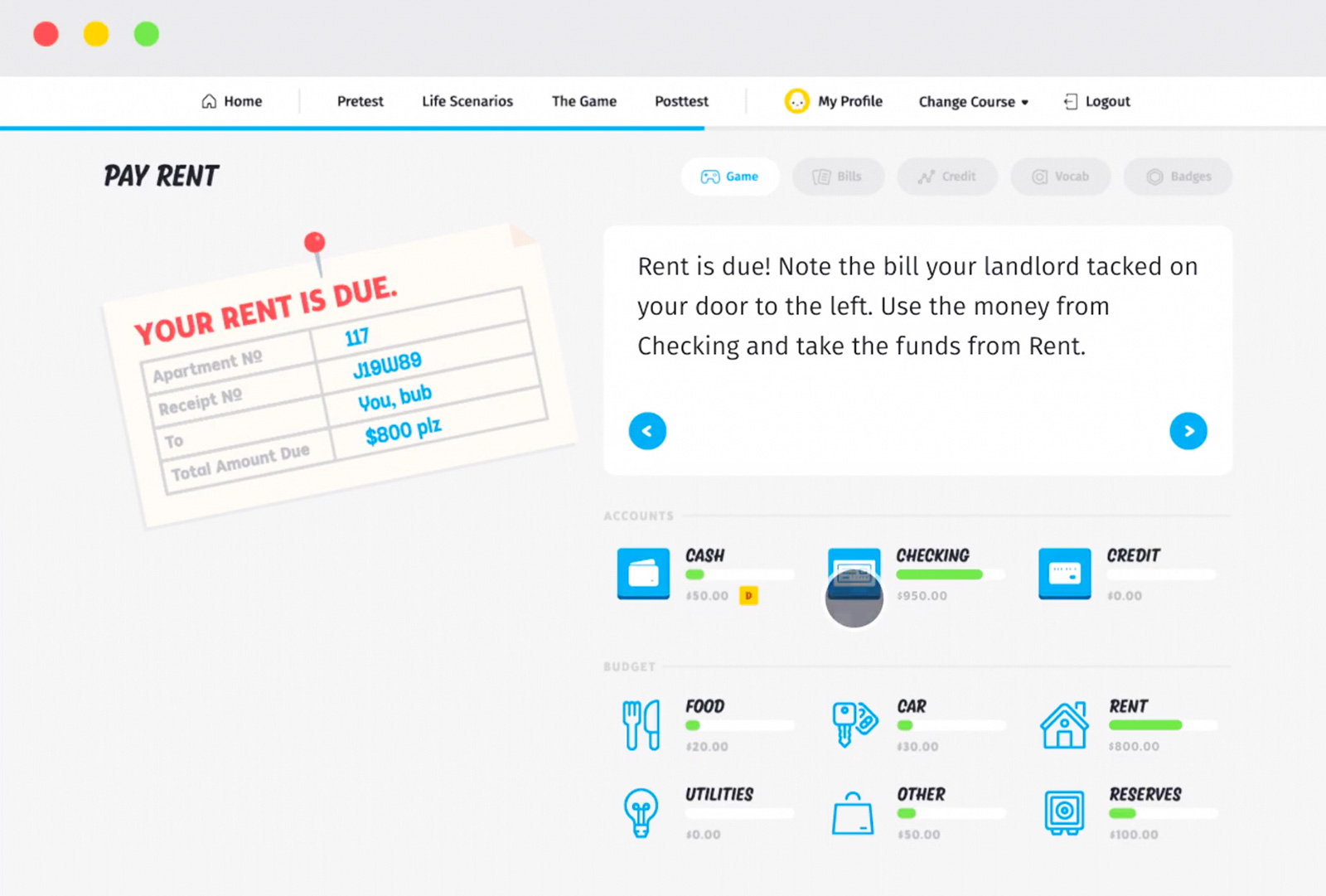

Banzai offers a variety of resources such as financial tools, articles and lessons for free. Online courses challenge students to manage a budget, save for a goal and deal with unexpected financial pitfalls while teachers monitor and grade student progress.

Fourth-grade teacher Lee Stultz of Cayuse Prairie School incorporates Banzai Junior, the elementary school program, into her social studies class, where her 10-year-old students are introduced to real-world finance basics like how to run a business, borrow money and then pay it back.

“I think Banzai is great because it touches on basics that the students never heard of,” Stultz said. “They’re learning about savings accounts, interest accounts and that if they put money aside it can grow.”

Each course within Banzai presents content that is tailored to different ages and situations. Along with Banzai Junior, which is geared for students 8-12 years old, there is Banzai Teen for early teens and Banzai Plus for students 16 and older.

“Banzai engages students with gaming scenarios,” Kroll said. “An online avatar wants to go to the concert, but they also need to pay rent or save for a car, and students navigate those decisions.”

Recently, Park Side Credit Union partnered with ServeMontana so that AmeriCorps volunteers could access the online platform, too.

“When employees don’t have money problems, a work environment is less stressful and more enjoyable, and teaching financial literacy to future employees will have that impact,” Kroll said.

Interested educators can learn more about NGPF’s Toolkit at www.ngpf.org. Educators and employers can access Banzai’s financial education at www.parksidefcu.com/education.