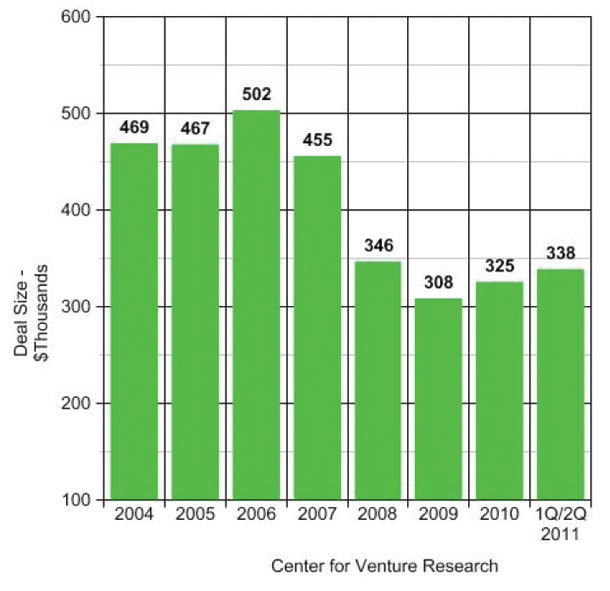

The Center for Venture Research at the University of New Hampshire has been publishing statistics on angel investing for decades. Over the past several years, the number of U.S. companies funded by angel investors has increased from about 50,000 per year to over 60,000 annually. Mark Boslet, senior editor with Venture Capital Journal, posted the following chart on peHUB, based on CVR reports. As you can see, in the past eight years, the average angel round has decreased from nearly $500,000 to under $350,000.

Why have we seen a drop in the size of angel rounds of investment? Several possibilities come to mind:

• The softness of financial markets has had a negative impact on the willingness of angels to fund larger rounds. Shallow pocketbooks have led to smaller rounds.

• The costs to startup companies, at least IT ventures, has decreased. Consequently, entrepreneurs need to raise less money

• Entrepreneurs have been willing to bootstrap companies (lower salaries, etc.), raising less money for early stage rounds, and enabling them to keep more ownership in their firms.

Two factors fly in the face of this trend:

1. The seed/startup marketplace is rather hot, especially in Boston, NYC and the Valley. Valuations of early stage deals are up significantly in these markets. I suspect the round size has increased as well.

2. Since 2007, Super Angels have really become active and, as a group, have been investing several hundred million dollars per year in early stage ventures. Their pockets are deep, with plenty of capital to invest at the seed/startup stage. My guess is that Super Angels are driving early stage round size up, not down.

In the sum, I see no definitive explanation for the decreasing average size of angel rounds. What do you think?

Columnist Bill Payne is an entrepreneur and angel investor. He may be reached by email at [email protected] or see his website at www.billpayne.com where his book “The Definitive Guide to Raising Money from Angels” is available. This is the seventh in a series of monthly articles in the Entrepreneurs’ Corner written by Bill Payne for the Flathead Beacon.