It’s Wednesday morning, the day after the election, and if you are like me, you got up, turned on the news, looked at the election results, then promptly threw up. The only bright side is that the election is over. Now we can all look forward to watching the Grizzlies beat the Bobcats on Nov. 19.

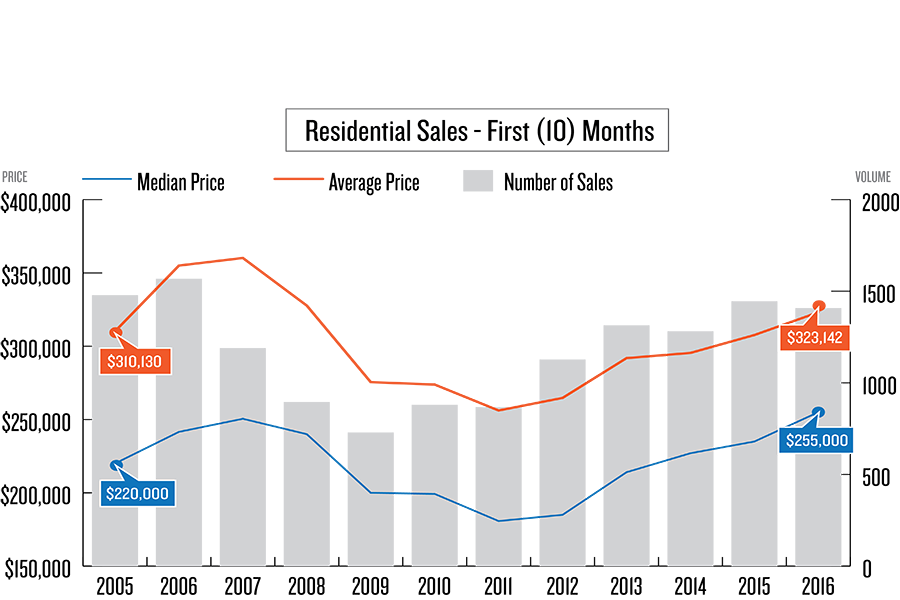

OK, I got that out of my system so let’s look at the first 10 months of residential home sales in Flathead County. The number of sales in the first four months of the year were up from the previous year, then the following three months were down followed by August and September, which were up, and now October had a 10 percent drop from October of 2015.

By the end of October there were 1,408 residential sales, compared to 1,445 sales in 2015. The total number of sales are down 2.6 percent from last year.

Mortgage interest rates continue at record lows with the average 15-year rate at around 2.8 percent and the average 30-year rate at around 3.5 percent.

In the first 10 months, 53.3 percent of residential sales were on small urban or suburban lots, 23.1 percent were on half acre to three-acre lots and 14.3 percent were on three- to 20-acre tracts. There were also 56 waterfront home sales, representing 4 percent of the market.

The median sales price for the first 10 months of this year was $255,000, compared to $235,000 for the same period in 2015. The 10-month median of $255,000 is 1.4 percent lower than the nine-month median, which was $258,750 at the end of September. The median home price of the 152 homes sold in October of this year was $240,000.

The current inventory level is substantially lower than what it was a year ago, as well as being lower than what it was a month ago. Currently there are 1,064 residential listings, compared to around 1,350 at this time last year. Of the 1,064 active residential listings in Flathead County, only 194 (18.2 percent) are priced below the median sold price of $255,000.

In the first nine months there were 58 bank-owned or distressed sales, compared to 108 in 2015. Non-distressed sales represent 95.4 percent of the market, compared to 91.5 percent for the same period in 2015.