Why do Realtors, appraisers and mortgage underwriters give so much weight, when valuing properties, to comps (comparables) sold nearby within recent months? What considerations are employed by the tax assessor?

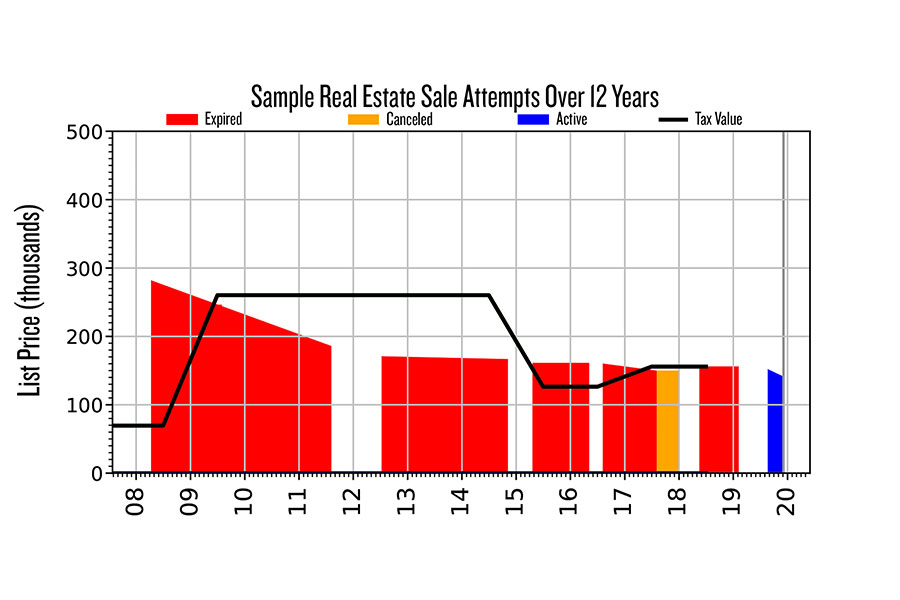

Look at this week’s chart, depicting the marketing efforts (for one undisclosed property in the Flathead Valley) and taxable values over the past dozen years. Red polygons are listings that ultimately expired, orange are listings that were canceled, and blue indicates that it is actively for sale right now. Years are along the bottom, with hash marks for each calendar month therein. The black line shows the actual county tax valuation. This property went up for sale at almost $300,000, and its tax valuation more than tripled within a year. Tax value stayed there for five years before dropping in half and undershooting the ask. Within two years, the valuation finally matched the ask.

With Montana being a non-disclosure state (withholding real estate sales results from internet conglomerates), perhaps I should compare Zestimates to reality and tax valuations, and evaluate accuracy of such algorithms (they supposedly cannot access comps).