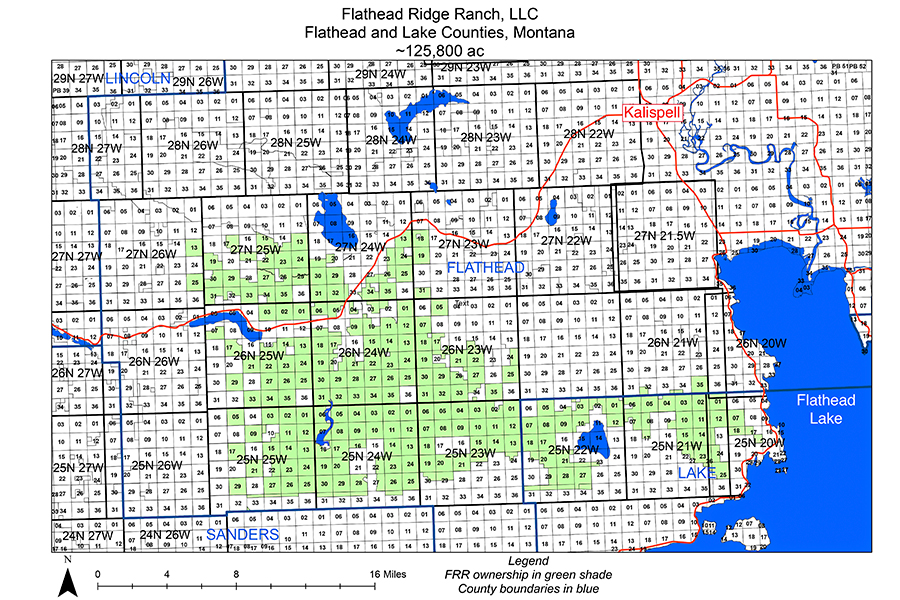

Texas Power Couple Acquires 125,800 Acres of Timberland West of Kalispell

New owner says purchase of land is a ‘family legacy investment’ and is in negotiations to allow some public access

By Tristan Scott

A Texas power couple with growing ties to Northwest Montana recently became the new owners of 125,800 acres of forested real estate west of Kalispell, on timberland surrounding Hubbart Reservoir and tracking east to Lake Mary Ronan, an expanse that for generations of Flathead Valley families has functioned as a haven for hunting, fishing and camping, as well as a rich source of timber for some of the region’s top forestry producers.

Under the new ownership, not much will change, according to Mark Jones, Chairman and CEO of Dallas-based Goosehead Insurance, who along with his wife, Robyn, the billion-dollar company’s founder, has been expanding the family’s real estate portfolio in the region — a “family legacy investment” he described as separate from their lucrative business ventures and their insurance empire.

“Northwest Montana is one of the most beautiful places on earth, and while we cherish the opportunity to own some of it, our intention is to keep this holding in our family for many generations,” Jones said in a Feb. 8 telephone interview with the Beacon. “This is not an economically oriented investment. It is a family legacy investment. We are going to enjoy it and we hope that our great, great, great grand kids can enjoy it, too.”

The land sale marks the most recent acquisition following a succession of sales and corporate takeovers in Northwest Montana, which have elicited anxiety among hunters, anglers and land managers who fret not only over the potential loss of longstanding access agreements, but also over the fragmentation of critical wildlife habitat and the degradation of water quality, particularly as looming development pressures provide a stark reminder that much of Montana’s outdoor heritage remains vulnerable.

According to Jones, the family has no plans for large-scale commercial development on the property, and he has already begun the process of negotiating future access agreements with state land managers, as well as exploring other conservation opportunities.

“One thing I want to be clear about is that we don’t have any plans for large-scale residential development of any kind,” Jones said. “Our objective is conservation, so from the outside it won’t look any different. This is a family legacy investment, so even though it’s a lot of land it does not represent part of my investment portfolio or part of my business strategy to make money.”

Jones emphasized that while he plans to move forward with an agreement to allow continued access on much of the property, that access will be contingent on the conduct of public users.

“It is our intention going into this to be good neighbors, but being good neighbors is a two-way street,” Jones said. “We hope that the public who wish to use this land is committed to being good neighbors, too.”

The previous landowner, Georgia-based Southern Pine Plantations, doing business in the region as SPP Montana, sold the acreage to the Joneses last month for an undisclosed amount of money. The timber and real estate investment firm has offloaded nearly a half-million acres of land in Northwest Montana in the first part of 2021 alone, flipping the parcels after acquiring them just over a year ago from Weyerhaeuser Company following that timber giant’s 2016 merger with Plum Creek Timber Company.

The recent sale to the Joneses is unique, however, in that the buyers are individuals with private interests on the land rather than a timber corporation or real estate investment firm, as has defined past transactions.

Originally from Lethbridge, Alberta, Mark and Robyn Jones now reside in Texas, where they’ve earned a fortune after bootstrapping Goosehead Insurance into an industry leader. Their self-made wealth has allowed them to begin laying deeper roots in the Flathead Valley, including construction of a home off Big Mountain Road, on 200 acres of land adjacent to Whitefish Mountain Resort that includes a manmade lake for boating. That undertaking, which is nearing completion, also prompted the couple to donate $600,000 to the Big Mountain Fire Department for the purchase of a new fire truck, a philanthropic gesture that also improves service to their new digs tucked outside of city limits.

According to Forbes, Robyn Jones founded the couple’s property and casualty insurance agency in 2003, while Mark, 58, left his senior executive consulting position at Bain & Company to join his wife in 2004. The Joneses’ wealth — at $1.1 billion, Forbes ranks Robyn’s net worth well above that of Kim Kardashian — and the couple’s humble origins as teenage sweethearts who raised six children in Alberta has made for a popular media narrative.

Through their newest holding, dubbed Flathead Ridge Ranch LLC, the family will continue to manage the existing timber supply, which has dwindled considerably in the wake of intense logging pressures from forestry giants like Plum Creek and Weyerhaeuser. But the primary goal will be to conserve the land, according to Ryan Langston, the Joneses’ son-in-law who will function as president of Flathead Ridge Ranch LLC, and is also general counsel of Goosehead Insurance.

“I will be overseeing operations on the property, including ongoing timber operations, as well as supporting all the conservation efforts,” Langston said, explaining that he’s working with American Forest Management to oversee the logging operations. “The idea is to keep the property running the way it has been for now, but we are not interested in extracting the maximum amount of resources. We’ve inherited some timber operations from the previous owners and those will continue into the near future.”

Despite the succession of corporate sales in recent years, much of the land has remained accessible to the public for recreation through a cooperative management agreement between the private owners and Montana Fish, Wildlife and Parks (FWP), the state agency whose block management program was voluntarily renewed by Plum Creek Timber Company for decades, allowing access to the private parcels in exchange for a patrol presence by state game wardens.

It’s a familiar area to hunters and anglers, and news of the sale has been rippling through local sportsmen communities, raising apprehension and touching off discussions about a long-term plan for access.

Settling concerns among outdoor recreationists and state officials for the time being, Jones said an unofficial version of the cooperative access agreement with FWP would continue while negotiations are underway on how to move forward with a more permanent arrangement.

The block management contract that SPP Montana entered into with FWP after purchasing 630,000 acres of Plum Creek land, a $145 million deal completed in January 2020, is set to expire at the end of May. But that agreement is dissolved on the parcels acquired in last month’s sale, rendering the existing access arrangement moot and raising the specter of closures.

Jones said he’ll work with FWP to organize a public forum this summer in order to discuss the access agreement openly and well in advance of the fall hunting season, gathering at a venue that can accommodate the high level of interest the sale is generating, such as the Flathead County Fairgrounds’ Expo Center.

The area includes tracts of land flanking Hubbart Reservoir, a 480-acre impoundment rimmed by cliffs and pine forests, and a popular ice-fishing destination in winter, while hosting anglers, campers and some keg parties most summer weekends at primitive sites. The property then runs east to Lake Mary Ronan, intersects with the Flathead Indian Reservation to the south and abuts U.S. Highway 2 to the north. Other popular access points along Red Gate Road, Hubbart Dam Road and Browns Meadow Pass Road are included in the sale.

Jim Williams, FWP’s regional supervisor in Northwest Montana, said he’s encouraged by his recent conversations with Jones, as well as by the family’s understanding of the region’s outdoor heritage and values and their interest in entering a cooperative management agreement.

“The good news is we have had some very productive discussions already with the new owners about exploring options for public access, not necessarily on all of the land, but on some of it,” Williams said. “Now, those discussions are ongoing, but what everyone needs to realize is that this is private land and it has been private land for a very long time. So people need to be extremely respectful when they are on these lands, particularly as the next set of rules is being developed.”

Williams said access has always hinged on the public’s stewardship, which is more critical now than ever.

“Virtually every land owner acquiring these former Plum Creek lands has been willing to sit down with us and talk about public access and honor that tradition and culture,” he said. “But there will be rules and people need to respect them.”

Jim Vashro, president of Flathead Wildlife Inc., said both the scope and timing of the sale are “astonishing,” particularly as it comes on the heels of another sale in which SPP unloaded 291,000 acres of nearby forestland to Green Diamond Resource Company. The transactions are occurring while two major land deals are underway to place more than 230,000 acres of prime hunting and timberland into conservation easements, which permanently protect private land from uses deemed incompatible with its natural or recreational values.

Officials with Green Diamond have pledged to continue enrolling in FWP’s block management program and agreed to help usher the easements into place, a tactic that augments their revenue streams in the form of conservation. Sportsmen groups hope the Joneses will be amenable to similar arrangements down the road, even as the immediate future is uncertain.

“Between the Green Diamond sale and now this, it’s just astonishing,” Vashro said. “To have a sale of this size to a private buyer is really something else.”

“People have used these corporate timber lands for decades and kind of regarded it all as public property,” Vashro continued, putting a sharper point on the sanctity-of-access issue. “But it was always private. So this kind of brings home how privileged we have been in the past, and hopefully that privilege will continue into the future. Those are really popular areas. I hunted Red Gate last year, and Hubbart Reservoir and Hidden Lake are really nice kokanee salmon and rainbow trout fisheries. But I think even more so now than ever people need to recognize it’s private land, that future management is still in flux and they need to be respectful.”