The Rise of Venture Capital in Montana

Bozeman’s Next Frontier Capital and Whitefish’s Two Bear Capital, along with other investors in Montana and out of state, are changing the state’s startup and biotech landscape

By Myers Reece

When the Bozeman-based venture capital firm Next Frontier Capital was founded in 2015, Montana ranked dead last in the United States in per-capita venture capital investment, according to a national association that tracks the industry.

Within five years, the state’s venture capital investment grew 10 fold, surpassing $150 million in 2019, according to a report released last year by Next Frontier Capital, which has played a central role in that growth.

And that tally came before the launch of another venture capital powerhouse, Whitefish-based Two Bear Capital, which was founded by Silicon Valley veteran Michael Goguen. Despite COVID-19 disruptions, Two Bear Capital invested tens of millions of dollars in 2020, including its lead role in the largest Series A investment in Montana history, a $22 million round announced in July to support Inimmune, a biotech company out of Missoula.

Additionally, millions of out-of-state equity finance dollars have poured into Montana companies: In 2018 alone, Goldman Sachs Growth Equity invested $25 million in Livingston-based Printing for Less, while Summit Partners, a global growth equity investor, led a $20.3 million funding round for Missoula-based onXmaps. The onX investment was called at the time the “largest growth equity investment in a mobile and consumer-focused business in Montana’s history.”

“We’ve seen exponential growth in venture capital in Montana,” said Christina Quick Henderson, executive director of the Montana High Tech Business Alliance. “It’s one of the biggest and most important stories related to tech in recent years. Over that five-year period, it’s mind blowing how much better the landscape has gotten.”

Liz Marchi, who is now Two Bear Capital’s head of community engagement, was an early pioneer in Montana’s equity financing field. She founded the state’s first angel investing fund, Frontier Angel Fund, in 2006, and has been involved in economic development for decades.

With a front-row seat, Marchi has witnessed venture capital’s role in Montana evolve from essentially nonexistent to critically fundamental in the startup landscape, which she calls “amazing.”

“Everybody tends to start with the money but it really is about the opportunity,” Marchi said, noting that equity financing drives the realization of business ideas that previously wouldn’t have been able to gain a foothold in Montana.

Marchi said equity-financed companies pay twice the average wage as bank-financed companies, and that potential for creating quality jobs was the impetus for her launching Frontier Angel Fund 15 years ago.

“I looked at Montana’s wages, and if you took out mining, our wages were absolutely rock bottom in the nation,” she said. “And in a global economy, wages rise when high-value jobs are created, and we just weren’t creating those types of jobs.”

Henderson said the emergence of Montana-based venture capital firms was a crucial development. Before, out-of-state venture capitalists interested in investing in Montana companies were deterred by the state’s distance from the nation’s tech and finance hubs, and often pressured the companies to relocate.

Firms such as Two Bear and Next Frontier have an on-the-ground presence, facilitating better communication, understanding the communities in which the companies are based, sitting on the boards, more efficiently leveraging deals and more.

While much of the investment in recent years has been focused on the state’s tech hubs of Bozeman and Missoula, Henderson said Flathead Valley companies are playing an increasingly large role, a trend that has been further accelerated by the headquartering of Two Bear Capital in Whitefish.

Five of the 10 companies listed on the Montana High Tech Business Alliance’s “startups to watch” in 2021 have raised angel or venture capital investment from firms such as Two Bear, Next Frontier and Frontier Angels.

Henderson also said targeted “accelerator” programs are important in fostering a more robust economic development and startup environment, including Early Stage Montana and C2M Beta, while Blackstone LaunchPad at the state’s two flagship universities provides entrepreneur resources for students.

Goguen, Two Bear’s founder, spent two decades with Silicon Valley-based Sequoia Capital, one of the most prominent venture capital firms in the world. Marchi said Goguen’s career puts him in the “top tier for VC globally,” and has accordingly elevated Two Bear’s status from day one.

“It’s absolutely a top-tier firm, in Montana,” she said. “It’s extraordinary.”

Henderson said Goguen’s firm serves as a magnet for other entrepreneurs and knowledge workers, bolstering the state’s existing attractants such as quality of life and outdoor amenities, along with an entrepreneur-friendly environment and legislative prioritization that existed long before the rise of equity capital.

“Even if it’s not necessarily VC help, there’s tangible help through Montana’s support system,” Henderson said. “What it is about Montana that makes our ecosystem great for entrepreneurs has distinct attributes from Silicon Valley.”

Marchi said venture capital creates opportunity in areas such as biotech that were previously hard to penetrate, even for angel investors, because it’s a “highly technical investment space.” One of the most notable biotech examples is Two Bear’s investment in Inimmune, a private company founded by nationally reputed vaccine scientists in Missoula.

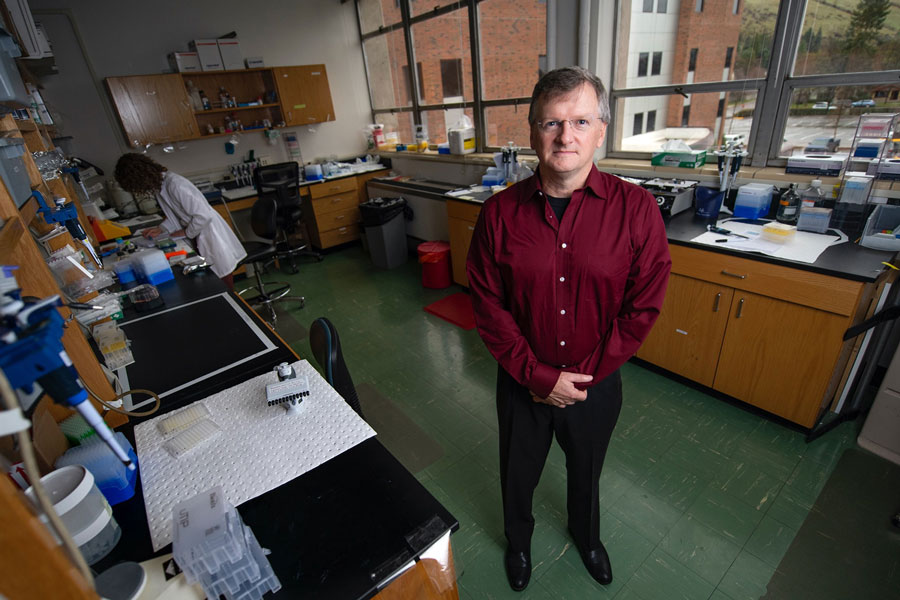

When the $22 million Series A investment was announced last July, Dr. Jay Evans, Inimmune’s cofounder, president and CEO, noted that the company’s principals “could have looked outside of Montana for investors but were happy to find a local VC firm that connected with our vision to grow a world-class biotech company right here in Montana.”

Evans, who is also the director of the University of Montana’s Center for Translational Medicine and a research professor in biological sciences, had previously told the Beacon that venture capital was a game changer for biotech in the state.

“What Mike (Goguen) is doing for biotech in Montana is pretty incredible,” Evans said last year. “Between Next Frontier Capital and Two Bear, if you’re a biotech company in Montana, they’re propping up the whole system.”