Lawmakers Mull Decision to Redistribute Marijuana Tax Revenue for County Road Upgrades

Lawmakers have one week to decide whether to overturn the governor's veto of SB 442, which would allocate millions of dollars to county road projects, including nearly $500,000 to Flathead

By Micah Drew

There is one week remaining for Montana’s legislators to determine whether to override Gov. Greg Gianforte’s veto of Senate Bill 442, a popular bipartisan measure that sought to change how marijuana tax revenue is distributed and would provide a boost to county road budgets. Lawmakers must submit their mail poll on April 18.

A recent analysis of the bill by the Legislature’s Office of Research and Policy Analysis, which relied on marijuana tax revenue figures from FY2023, showed that, under SB 442, Flathead County would be slated to receive a nearly $500,000 boost to its road department budget if the law took effect. Lincoln County would receive $368,923, a roughly 8.3% boost to the budget.

“Certainly, we would find plenty of ways to spend that money wisely on our roads because of the impacts of growth and the impacts of increased tourism,” Flathead County commissioner Randy Brodehl said this week. “We’re struggling to keep up with the quality of our roads, so it would be put it to direct use.”

A recent column written by the Montana Association of Counties (MACO) Board of Directors called the legislation a “thoughtful distribution of this higher-than-expected new revenue stream” that includes upgrades to county roads, an often overlooked and underfunded piece of the public infrastructure puzzle.

Gov. Gianforte’s veto, which came on the last day of the 2023 legislative session, characterized SB 442 as creating a “slippery slope” by spending state funds on local infrastructure. Pushing against that, MACO wrote that “Montanans have always benefited from state resources provided to local governments,” and that “ALL Montanans benefit from infrastructure investments.”

Flathead County contains around 2,673 miles of roads, according to the state’s analysis. Dave Prunty, the county’s public works director, said his department actively maintains close to 836 miles of roads, 500 of which are unpaved and require expensive annual maintenance work.

The popular North Fork Road that stretches from Columbia Falls north to the Canadian border and provides access to two of Glacier National Park’s entrances is almost entirely unpaved, costing the county around $300,000 per year to maintain its 40 miles of washboarded gravel.

“We’re always trying to do the best we can with the money we have to keep up with the roads in our county,” Brodehl said. “But, the poll might not come out anywhere close to how the legislators voted during the session.”

During last year’s legislative session, Sen. Mike Lang (R-Malta) sponsored SB 442 to redistribute greater portions of marijuana revenue to Montana Fish, Wildlife and Parks, veterans and county roads, as opposed to funneling most of the money into the state’s general fund, which is the current law.

The bill passed the 2023 Legislature after receiving support from 130 of the state’s 150 lawmakers, with five opponents representing districts in the Flathead Valley. Gov. Gianforte vetoed the bill on the last day of the legislative session, but it was not read aloud in the Senate chamber before the body adjourned. The timing of the veto and the motion to sine die caused confusion as to whether the Legislature had the power to override the veto and whether it could be procedurally accomplished as an out-of-session mail poll.

Several conservation districts and MACo sued the governor and secretary of state, and Lewis and Clark County District Court Judge Mike Menahan ruled that lawmakers may challenge the veto. The Montana Supreme Court upheld that decision last month.

To override the veto via mail poll, at least two-thirds of the members of each chamber must vote in favor of doing so, which, despite the bipartisan support in session, appears increasingly unlikely given recent rhetoric by legislative leaders.

A March 18 letter sent by GOP Senate leadership and signed by 27 members of the caucus stated that the poll violates the separation of powers among the three branches of government.

Lang, the bill’s sponsor, did not sign onto the letter, but wrote a rebuttal column stating that the bill “brought Montana together in a time when division is the preferred course of action in politics,” and urging lawmakers to support the bill.

Legislators have until 5 p.m. on April 18 to submit their mail poll.

Changes to marijuana tax revenue distribution

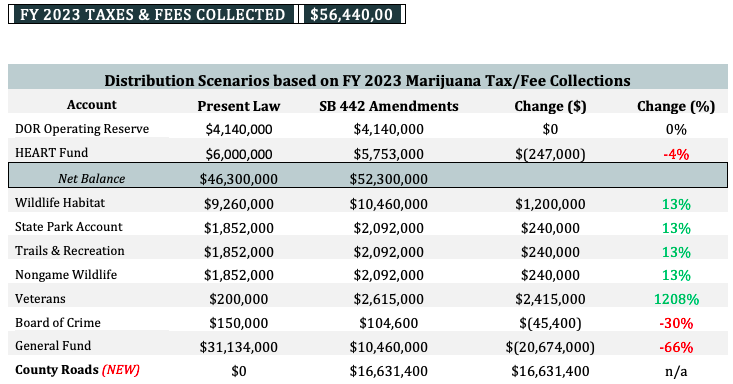

The present law allocates revenue in the following way:

- $6 million to Healing and Ending Addiction through Recovery and Treatment (HEART) fund

- 20% for funding wildlife habitat

- 4% each to state parks, trails and recreational facilities, and nongame wildlife

- The lesser or 3% or $200,000 for veterans and surviving spouses

- $150,000 for the Board of Crime Control

- Remainder to the general fund

Under the SB 442 amendments, the HEART fund would receive a percentage of revenue (11%) as opposed to a specific number, veterans would receive 5% of revenue, Board of Crime 0.2% and county roads 20%.

The county road formula is based on each county’s number of rural roads, Block Management Acres and Federal and Trust Acres. Flathead County’s estimated distribution of $492,950 is the highest in the state, followed by Phillips ($406,135), Beaverhead ($393,228), Valley ($389,053), and Lincoln ($368,923) counties.