What’s coming sooner than you think?

Retirement.

Don’t run away, 20 and 30-somethings.

Even if you’re 22 and three years into your new business, these issues should be on your mind unless you want to do more or less exactly what you’re doing now for the next 30-40 years.

We’re talking about the difference between building a business and building a job.

No one will buy your job. Lots of people would be interested in buying your business – if you can show proof of the things people want to buy.

So what’s the difference between the two?

- A job has no cash flows. It has a salary exchanged for day in, day out work. Vacation/sick time aside, a job doesn’t generate income when you don’t work.

- A business has cash flow. It delivers revenue whether you work or not.

To quote Mary Meeker (Kleiner Perkins partner and investor): “The value of a business is the current value of future cash flows.”

Business buyers are always interested in buying an income stream. They’re never interested in buying a job.

Model the outcome you seek

Last week, I was having a conversation with someone about upgrade pricing for their core product.

It led to a conversation about pricing a new product and pursuing new customers, which lead to retirement-after-selling-out discussions.

Why did that happen? Because we had to settle on some parameters for the retirement/selling out discussion before we could have a coherent discussion about product pricing.

Pricing shouldn’t be random. Sure, it has to reflect the value you deliver, but it also has to reflect your business and personal goals. Much of the time, it seems to reflect little more than whatever your competition charges, plus or minus a little.

“What the market will bear” is what sets the price for commodities.

Arriving at your number

So how do you get to “your number”?

Let’s say you want $5 million when you sell. If you settle for three times annual cash flow (it could be one, it could be 10), that’s $5MM/3. At what annual revenue do x customers get you that number every year? What do you have to sell them to make that?

For the sake of discussion, we’ll assume it takes 500 customers. There’s your average. Where are you now? How many new customers do you need to get to the right number? How much more do you need to come up with in real value to get that from existing customers?

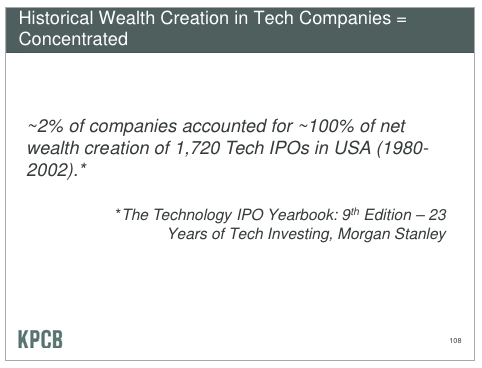

Finally, for those who have their sights set on making it big with an initial public offering (IPO)….don’t let the haters dissuade you, but do pay attention to history.

No one has ever IPO’d a job

IPOs aren’t a phenomena limited to Silicon Valley, though the resources there make it easier to put the right conditions together. Despite that, it can happen anywhere. In fact, it has happened right here in rural Montana.

From KPCB again:

Build something that will run on all cylinders even when you’re sick, on vacation, caring for a parent or simply want to take a random day off. Over the long term, perhaps your leadership will be needed, or perhaps you’ll hire someone who leads better than you do. Five years (or five days) from now, you might find something else that gets you up at 4 a.m. raring to go.

Rather than close that other business you built – find a great manager to run it. You can’t do that with a job.

You may love what you do and think you can do it forever. You may be right. Positioning your business so that you can change if you need or want to, will also position you more ideally for whatever your future holds.

Somewhere down the road, it’s likely that you’ll want to sell your business. If you can show recurring cash flow that doesn’t depend solely on your labor, it’ll be a lot easier.

Where you are today

If your business is “just you” and really does resemble a job, that’s OK. As you look forward, consider how you want things to look as time passes – particularly when selling the business crosses your mind.

One more time…. “The value of a business is the current value of future cash flows.”

Want to learn more about Mark or ask him to write about a strategic, operations or marketing problem? See Mark’s site, contact him on Twitter, or email him at [email protected].