Two Competing Bills Aim to Settle Cannabis Tax Revenue Debate

A compromise measure has emerged to fund habitat conservation while also maintaining county roads, supporting vets and funding drug treatment programs; meanwhile, a bill to divert weed revenue to the general fund has passed the House

By Tristan Scott

A contentious bill advancing in the Montana Legislature would shunt marijuana tax revenue away from programs dedicated to supporting wildlife habitat, trails, state parks, and recreational facilities and into the state’s general fund, where proponents say it could be allocated to meet a wider range of budgetary needs and be subjected to a higher degree of legislative scrutiny. However, opponents of the measure say it defies a budgetary blueprint that 56% of the state’s voters approved by initiative in 2020 when they legalized adult-use recreational marijuana, furnishing the state’s premier habitat conservation program with a permanent windfall.

To resolve the cannabis-tax-revenue debate, a compromise measure emerged late this week and quickly gained support from a diverse coalition of more than two-dozen stakeholder groups.

For months, lawmakers have jostled for a share of the lucrative new revenue stream generated by Montana’s expanding recreational adult-use cannabis industry. The debate has resulted in competing proposals to reconfigure the funding formula that lawmakers authorized during the 2021 legislative session. Those proposals included Senate Bill 442, a measure introduced by Sen. Mike Lang, R-Malta, which was originally worded to scuttle a portion of the marijuana tax revenue slated for Habitat Montana in favor of improving funding for county roads.

However, Lang revised the bill this week so that it provides stable funding for county roads while also supporting veterans and drug treatment services, and it establishes a new Habitat Legacy Account to conserve habitat and restore more of Montana’s land and waterways.

The amended version of SB 442 unanimously passed out of the Senate Finance and Claims Committee on March 30.

“I think we’ve made some pretty smart changes here that are intended to invest in rural Montana’s roads, lands and hunting opportunities while providing support for our veterans and a growing need for drug treatment,” Lang said. “At the end of the day we want to give our local counties and local people the tools and resources they need to improve the conditions of the land and be good stewards of Montana.”

In the span of 24 hours, the list of proponents advocating on behalf of SB 442 has grown rapidly to include a diverse coalition of more than two-dozen hunting, fishing and conservation groups, who are now poised to square off against another measure gaining momentum in the Legislature.

On Friday, March 31, House Bill 669 passed its second reading in the House of Representatives in a 65-35 vote and now heads to the Senate for consideration. Introduced by Rep. Bill Mercer, R-Billings, the measure would divert marijuana tax revenue away from most of the special programs that voters supported in 2020 when they approved Initiative 190 to legalize recreational marijuana. Those revenue streams were codified during the 2021 legislative session, which passed House Bill 701.

The only program Mercer’s bill leaves intact is the Healing and Ending Addiction Through Recovery and Treatment (HEART) Fund, which was proposed by Gov. Greg Gianforte.

Up to $6 million of marijuana tax revenue would be funneled into that account to be used for substance use disorder prevention, mental health promotion, crisis treatment and recovery services.

After the initial $6 million, HB 701 allocated 20% of cannabis tax revenue for Montana Fish, Wildlife and Parks (FWP) to be used solely by Habitat Montana, a program that pays for permanent conservation easements, fee-title land acquisitions and maintenance. Additionally, 4% was earmarked for state parks, trails and recreational facilities, and nongame wildlife. For fiscal year 2022, those amounts were capped at $650,000, but the cap was raised to $1,082,000 in FY 2023.

According to Mercer, HB 669 would ensure that the revenue streams from recreational marijuana receive a higher degree of scrutiny before they’re allocated to the special programs.

“Under 669, it would simply say that that revenue should go to the general fund and the Legislature as a whole should decide how it wishes to spend that revenue,” Mercer told members of the House Appropriations Committee last month. “One of the reasons that I wanted to bring this bill is that I fear that, when you essentially begin to earmark dollars for special revenue accounts, they evade review on an ongoing basis. Every time we have a diversion into a special revenue account, I worry that it doesn’t get the same sort of scrutiny that it does in the general fund.”

“I don’t think we should be deprived of being the decision-makers on this,” Mercer added.

Jim Vashro, president of Flathead Wildlife Inc., disagrees, saying that Montana voters should be the decision-makers, and that they decided how they wanted the money spent when they cast their ballots in 2020.

“We would hope that the Legislature would listen to the voice of the people,” Vashro said. “We are trying to protect the Habitat Montana funding, which was the stated intent of Initiative 190 (to legalize adult-use recreational marijuana),” Vashro said. “This amended bill does that and more. In addition to supporting Habitat Montana, it serves as a grant program for conservation districts, cities and counties working on problems ranging from soil erosion to noxious weeds, so in general it would be more flexible.”

Historically, the Habitat Montana program used big game license fees for habitat conservation and to protect public access, safeguarding hundreds of thousands of acres in Montana since it was established four decades ago. Most recently, it enabled the purchase of the Big Snowy Mountains Wildlife Management Area, protecting critical winter range for elk and deer while unlocking access for hunters by acquiring easements. It has also created more fishing access sites on rivers and lakes.

In the Flathead Valley, the Habitat Montana program helped fund the purchase of the 772-acre Bad Rock Canyon Wildlife Management Area along the Flathead River near Columbia Falls, allocating $2.5 million for the project. The Habitat Montana program has grown more robust since it began collecting money from recreational marijuana sales, giving land managers more certainty as they lay long-term plans for habitat protection.

“For conservation, we need more stable and long-term funding sources, and pulling money out of the general fund through a biennium appropriation doesn’t allow for that long-term planning,” Vashro said. “And particularly right now in northwest Montana, where so much private timberland is on the chopping block, we have a lot of habitat to protect. The price of land is going up and we need some guaranteed funding to make sure we can retain the current uses of this landscape.”

Noah Marion, of Wild Montana, said Mercer’s bill leaves too much room for uncertainty, and that critical habitat conservation projects would languish between biennium allocations from the general fund.

“These project take multiple years and if we don’t have the ability to plan into the future, or if we have to wait two years for an appropriation, we are going to lose a lot of opportunities,” Marion said. “We all know that there are a lot of folks coming into the state with a lot of money and buying up land. And regular Montanans want to make sure that these opportunities are available for them. A lot of these folks are taking these lands out of agricultural production and turning them into private hunting reserves. It’s important that we have a guaranteed source of funding available.”

According to Lang, the sponsor from Malta, his amended bill is intended to meet the needs of the state’s competing interests, including rural Montana’s counties, agricultural producers, hunters, and the state’s growing need to support veterans and drug treatment programs.

What it Does

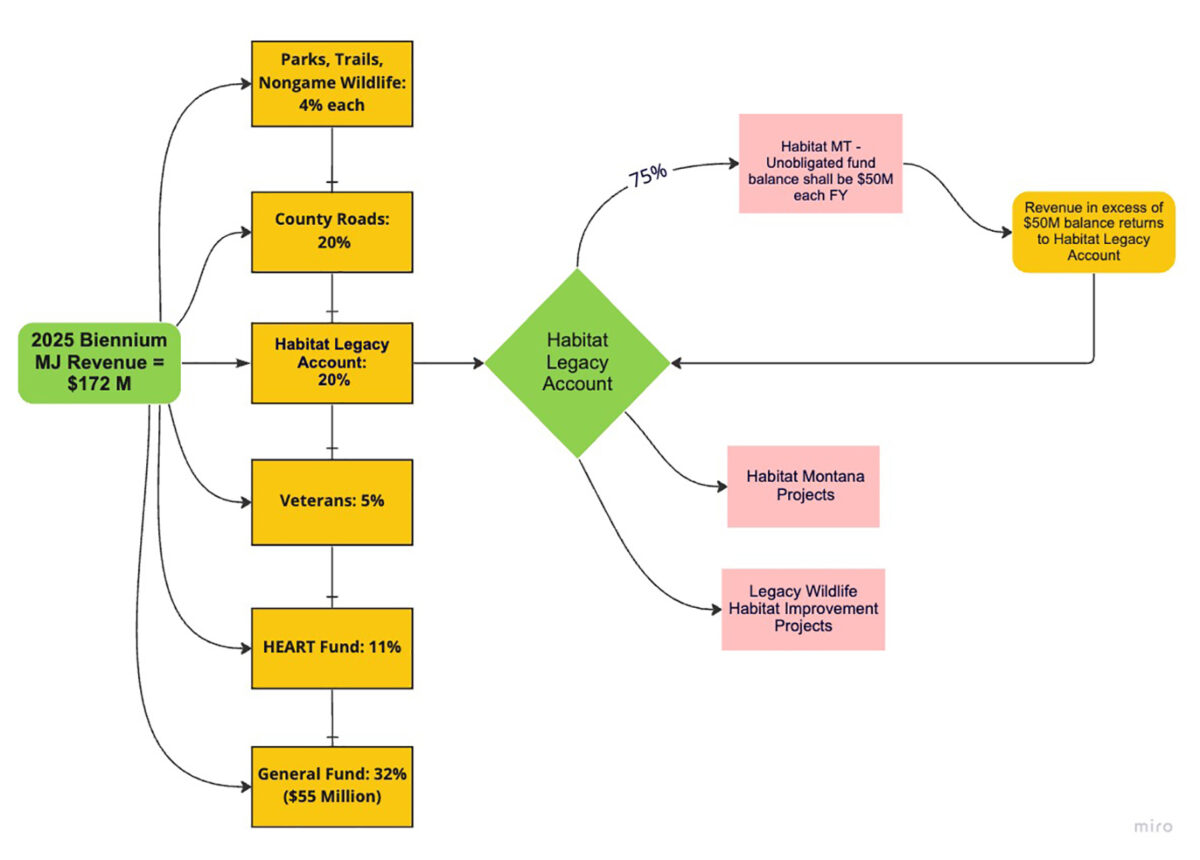

Senate Bill 442 proposes to redistribute cannabis tax revenue for the following purposes:

- Provides stable and sustainable funding for county roads (20%).

- Funds the HEART fund at the same level suggested by the governor’s executive budget (11%).

- Funds tax relief for veterans and surviving spouses at the same level suggested by the governor’s executive budget (5%).

- Maintains existing funding allocations for state parks, public trails and facilities, and non-game wildlife accounts (4% each).

- Establishes a new Habitat Legacy Account to fund traditional conservation tools under the Habitat Montana Program and expand the pace and scale of habitat stewardship and restoration treatments across rural Montana.

- Sets aside remaining revenue for the state general fund (32%).

A full list of organizations who support the bill include: American Woodcock Society; Anaconda Sportsmen; Archery Trade Association; Boone and Crockett Club; Ducks Unlimited; Fishing Outfitters Association of Montana; Flathead Wildlife Inc.; Hellgate Hunters and Anglers; Laurel Rod and Gun Club; Montana Artemis Alliance; Montana Bowhunters Association; Montana Chapter of Backcountry Hunters & Anglers; Montana Chapter of National Wild Turkey Federation; Montana Outfitters and Guides Association; Montana Trout Unlimited; Montana Union Sportsmen Alliance; Montana Wildlife Federation; Montana Wild Sheep Foundation; National Deer Association; National Wildlife Federation; Pheasants Forever; Quail Forever; Rocky Mountain Elk Foundation; Ruffed Grouse Society; Theodore Roosevelt Conservation Partnership; Traditional Bowhunters of Montana; and the Wild Sheep Foundation.